Forex trading revolves around the ability to forecast currency shifts to secure profitable transactions. Among the various tools available to traders, the Currency Strength Meter stands out as an essential instrument. It helps in determining the relative strength of different currencies, which is crucial for selecting the most advantageous currency pairs for trading.

The Currency Strength Meter offers visual representations of currency changes, assisting traders in understanding market trends. This article provides a guide on how to effectively utilize the Currency Strength Meter to refine your Forex trading strategy.

Understanding the Currency Strength Meter

The Currency Strength Meter is a technical analysis tool that measures the strength of currencies in the Forex market. It compiles real-time exchange rate data from various currency pairs and presents it in a clear and comprehensible format, often using graphs or numerical scales.

This tool ranks currencies from the strongest to the weakest, enabling traders to identify potential trades based on current market conditions. It is invaluable for both novice and experienced Forex traders, particularly those involved in fast-paced trading strategies such as day trading or scalping.

How the Currency Strength Meter Works

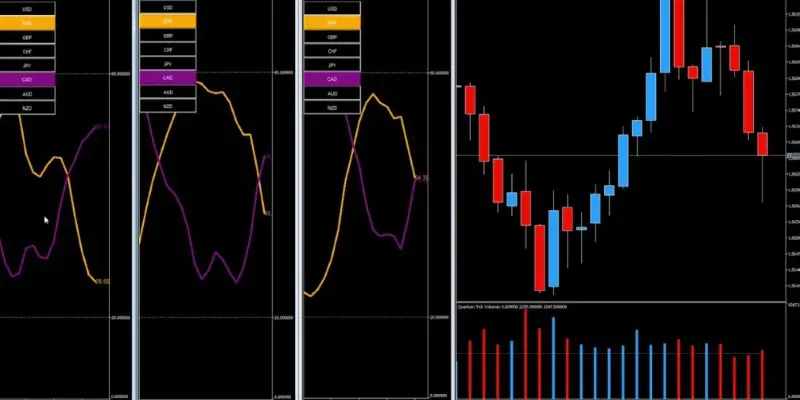

The Currency Strength Meter evaluates a currency's performance across various pairs and calculates its relative strength. It collects real-time exchange rate data from several currency pairs (e.g., EUR/USD or GBP/USD) and assesses how each currency performs against others. The tool employs algorithms to process this data, sometimes incorporating factors like volatility or trading volume for a more accurate assessment. The outcome is typically displayed as a chart or numerical ranking, showing which currencies are gaining or losing strength.

Traders can adjust the time frame to match their trading preferences, whether they are short-term scalpers or long-term investors. Some advanced meters may even include directional indicators to show whether a currency is increasing or decreasing in strength, offering further insights into potential market trends. While useful, it is recommended to use the currency strength meter in conjunction with other tools for a comprehensive market analysis.

Integrating the Currency Strength Meter into Your Trading

With your currency strength meter at hand, here are the steps to integrate it effectively into your trading strategy:

Identify Strong and Weak Currencies

The main purpose of the currency strength meter is to help traders identify the strongest and weakest currencies. Traders generally aim to pair a strong currency with a weak one to maximize profit potential. For instance, if the meter indicates that the USD is strong and the JPY is weak, a trader might choose to buy the USD/JPY pair, anticipating that the USD will rise against the JPY.

Confirm Trends

While the currency strength meter highlights currency strength, it is essential to validate trends with additional technical indicators. After identifying a strong or weak currency, traders can use tools like the Relative Strength Index (RSI), Moving Averages, or Bollinger Bands to confirm the trend and ensure the meter's readings align with market behavior.

Avoid Ineffective Trades

Currency strength meters are beneficial for managing portfolio risk. If a trader holds multiple positions, the meter can help prevent placing trades that cancel each other out. For example, if you're long on the USD/EUR and short on the USD/JPY, you might inadvertently be betting both for and against the USD. By recognizing correlations between pairs, you can avoid taking opposing positions that negate your profits.

Hedging Strategies

Traders can also use the currency strength meter for hedging. If you anticipate a currency's value might decline, you can open a position in a currency pair with a negative correlation to protect yourself from losses. For example, if you're concerned that your long position on the GBP/USD may depreciate, you might hedge by taking a position on USD/JPY, where the dollar could strengthen if the pound weakens.

Scalping and Quick Trades

For short-term traders, the currency strength meter can be an invaluable asset for scalping. By focusing on currencies showing rapid fluctuations in strength, traders can make swift trades to capitalize on fleeting market movements. However, this