The financial industry is currently experiencing a significant metamorphosis, propelled by the progress in artificial intelligence (AI). Financial entities are progressively integrating AI to elevate the customer experience. This piece explores the transformative effects of AI on financial services, particularly in the realms of customized banking solutions and their influence on enhancing customer satisfaction.

AI in the Financial Sector

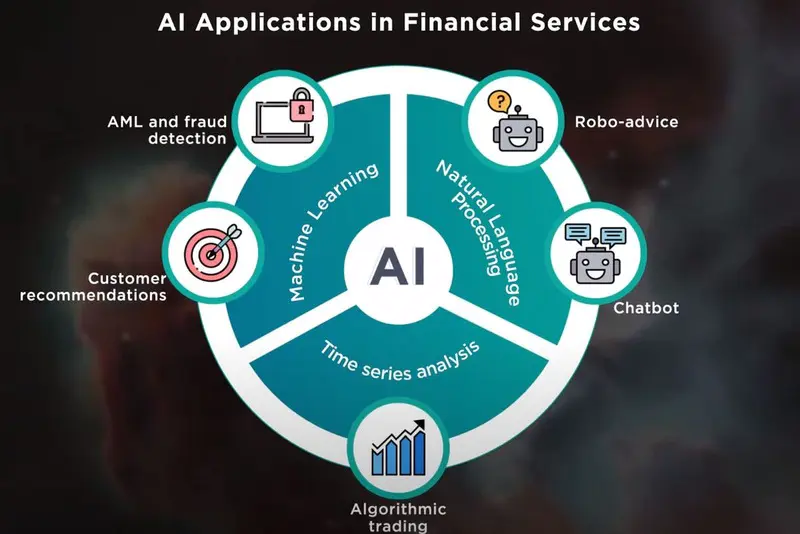

Artificial intelligence is a collection of technologies that mimic human cognitive functions. In finance, this includes machine learning, natural language processing, and predictive analytics. These technologies enable institutions to sift through extensive data, detect trends, and automate tasks, thus improving service efficiency. The adoption of AI allows banks to optimize operations, minimize expenses, and refine decision-making, offering mutual benefits to the entities and their clientele.

AI not only automates processes but also deepens the comprehension of customer requirements. By examining historical and current data, AI offers insights into customer inclinations, allowing for more precise service customization. This enhanced understanding solidifies the bond between financial institutions and their customers, promoting enduring relationships.

Data-Informed Decisions:

Operational Scalability:

Enhancing Customer Engagement

AI's impact on finance is particularly notable in its capacity to enrich customer interactions. AI-driven chatbots and virtual assistants offer immediate responses to inquiries, enhancing response times and accessibility. By managing routine questions, these systems free up human staff to address more intricate matters. Moreover, AI assesses customer interactions to pinpoint common issues and areas for enhancement, enabling continuous service improvement.

Beyond mere reactive responses, AI systems anticipate customer needs based on past interactions. This proactive approach boosts customer satisfaction and loyalty by resolving issues preemptively, creating a seamless and valued customer journey.

Proactive Engagement:

Feedback Loop:

Tailored Banking Solutions

AI's data processing capabilities enable financial entities to offer banking solutions that cater to individual customer needs. By scrutinizing customer behavior and transaction histories, AI can suggest products and services that align with their preferences. For instance, AI might recommend personalized investment options based on a client's risk profile or offer financial advice based on spending habits. This level of customization not only satisfies customers but also encourages loyalty, as clients perceive their banks as understanding and valuing them.

Customization extends to marketing, where AI can tailor communications to individual preferences, increasing engagement and conversion rates. By leveraging personalization effectively, banks can strengthen their customer relationships.

Targeted Communications:

Loyalty and Retention:

Risk Management and Fraud Prevention

AI is pivotal in bolstering risk management and fraud detection within financial services. Machine learning algorithms can analyze transaction patterns in real-time, identifying anomalies that suggest fraudulent activities. By leveraging historical data, AI tools can predict potential risks and assess the likelihood of loan defaults or investment losses. This proactive stance protects institutions from substantial losses and safeguards customers by ensuring the security of their information and assets.

The implementation of AI in fraud detection systems can significantly expedite the identification of suspicious activities. This rapid response capability helps prevent losses before they escalate and maintains customer trust. These systems continuously evolve their ability to detect fraudulent behaviors by learning from new data.

Real-Time Surveillance:

Adaptive Learning: